where's my unemployment tax refund 2020

You may check the status of your refund using self-service. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits.

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Access Tax InformationForm 1099G Using UI Online.

. Tax refunds on unemployment benefits to start in May. Otherwise the IRS will mail a paper check to the address it has on hand. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

To check the status of your personal income tax refund youll need the following information. Form 1099G reports the total taxable. How To Call The Irs If Youre Waiting On A Refund.

As of May 30 2021 TWC will use only 50 percent of a claimants weekly benefit amount WBA to repay their overpayment unless otherwise required by law. The refund will go out as a direct deposit if you provided bank account information on your 2020 tax return. The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits.

There are two options to access your account information. Special rule for unemployment compensation received in tax year 2020 only. 1222 PM on Nov 12 2021 CST.

Its best to locate your tax transcript or. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

2020 Individual Income Tax Information for Unemployment Insurance Recipients. If you received unemployment benefits in 2020 a tax refund may be on its way to you. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Check For The Latest Updates And Resources Throughout The Tax Season.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Tax year of the refund. File Wage Reports Pay Your Unemployment Taxes Online.

Account Services or Guest Services. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Where is my direct deposit tax refund.

If you use Account Services. See How Long It Could Take Your 2021 State Tax Refund.

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

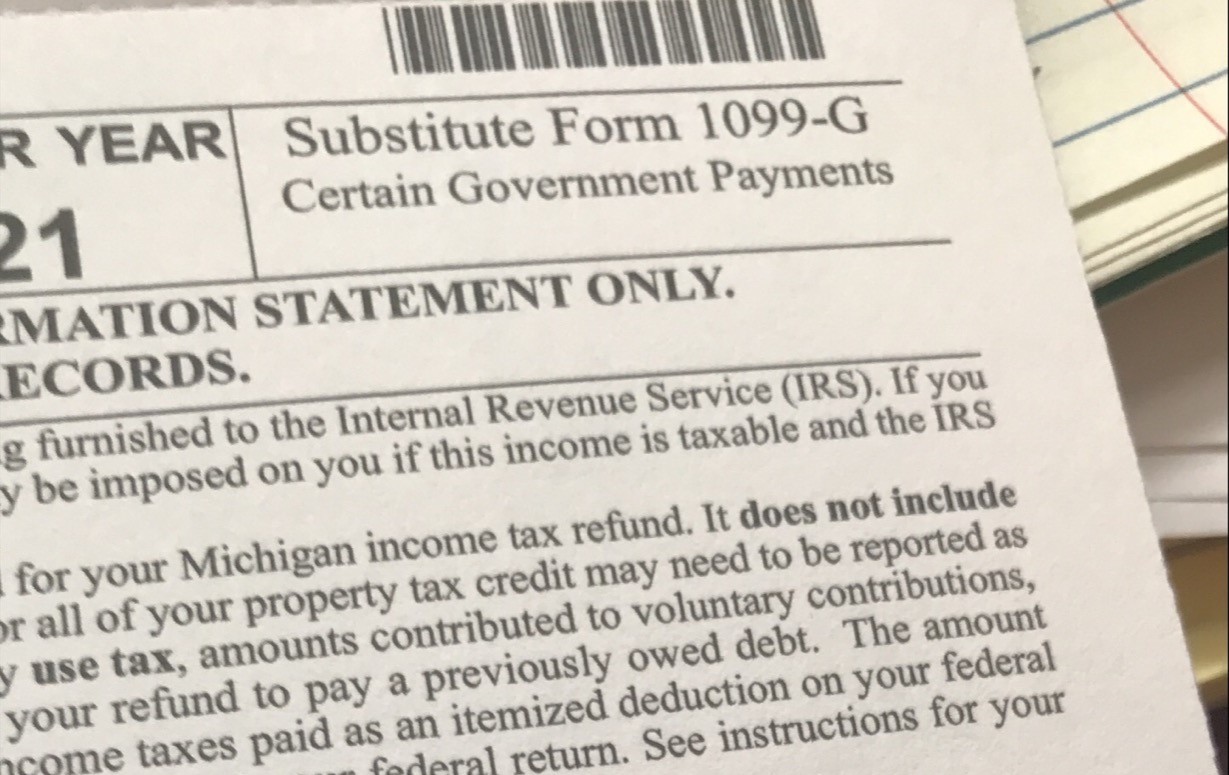

Form 1099 G Certain Government Payments Definition

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

1099 G Unemployment Compensation 1099g

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Unemployment Tax Refund When Will I Get My Refund

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says